Whitney Economics Analysis of New York Licensing

Summary:

-

New York is major U.S. cannabis market with a remarkably small amount of legal market participation.

-

New York will not be able to win consumers to the legal market with only small operators due to the lack of sufficient supply resulting in higher prices.

-

Larger operators can help transition the New York market into a legal regulated marketplace.

-

If allowed to participate, larger operators could absorb market risk and volatility, which would enable a smoother and more predictable rollout for smaller firms.

-

With the successful support of the initial surge in legal demand by larger firms, more smaller firms will remain viable and the social equity program will be sustained.

Objective:

The objective of this analysis is to provide an analysis of the New York legal regulatory environment and to assess the economic and business impacts of current policies.

Executive Summary:

New York is in the process of deploying a legal adult-use cannabis market. The state of policies and policy development is still in flux. Currently, New York’s policy is to favor smaller firms that are social equity applicants while erecting significant barriers to entry for larger firms in an effort to avoid granting larger firms too much influence over the adult-use system. From an economic perspective, this policy approach is putting the social equity applicants at risk of failure, while at the same time it is establishing a system that slows the rate of consumer participation in the legal market. These policies limit the industry’s effectiveness and do not appear to achieve other policy objectives.

We believe that a key driver to the successful deployment of the New York legal cannabis market is to enable larger firms to supply the market as it ramps, in order to give smaller firms the time to ramp up. It will place much of the risk, and yes, the reward, onto larger firms, while reducing the risks that smaller firms face in a newly established market. As long as there are limits to how much influence larger firms can have on the market, in the short run, New York state can avoid capitulating the market to larger firms, while at the same time improving the chance for success for the smaller, more diverse businesses that have a place in New York’s cannabis industry.

Introduction:

New York Cannabis: A Huge Market with Little Legal Participation

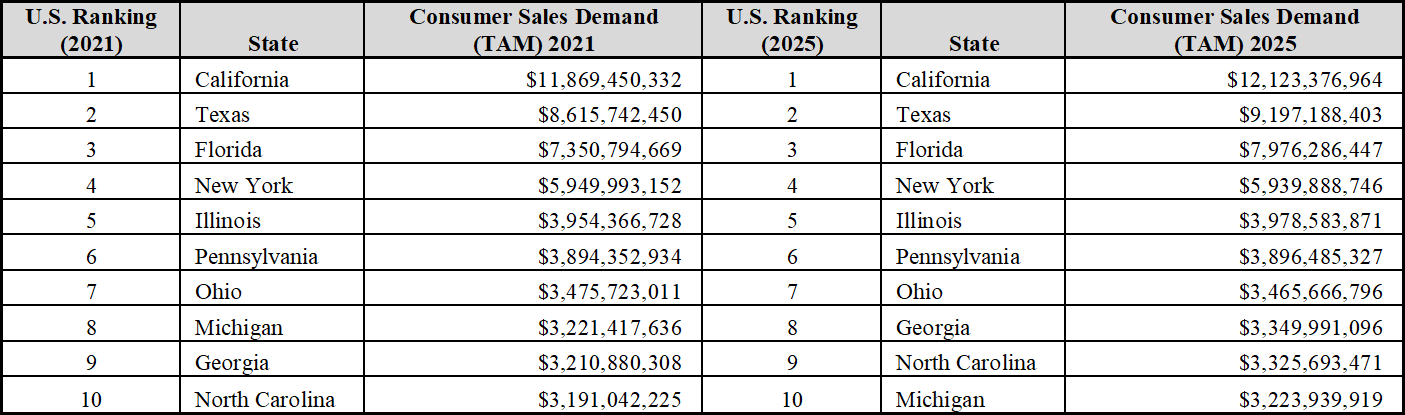

The New York cannabis market is one of the largest cannabis markets in the United States. Based on population and consumption, New York ranks 5th in terms of total addressable market (TAM). The TAM value is estimated to be $5.9 billion, and legal participation in the market declined from 8.2% in 2021 to 5.5% in 2022. Currently the legal regulated market is in its nascent stages of deployment. The vast majority of the demand is satisfied by a very formidable and sophisticated illicit market. Medical patients are not purchasing from medical retail outlets, instead favoring supply from the illicit channel. Consumer conversions from illicit to legal channels is a high priority in terms of public policy.

Source: U.S. Census, Whitney Economics

Source: U.S. Census, Whitney Economics

Illicit to Legal: The Three Keys to Successful Conversion

Data has consistently shown that the speed and seamlessness of illicit to legal consumer cannabis conversions depend upon three factors: adequate supply, retail access and price relative to the illicit market. There is a balanced approach that can be made between limited licensure and creating an environment whereby supply and demand is balanced, consumer conversions are maximized and firms can have a greater chance to be profitable.

There is No One Size Fits All Policy for Deploying Legal Cannabis State Regulatory Programs

The deployment of a legal regulated cannabis program is a difficult task. Most state programs take between 18 – 36 months to evolve, and they experience multiple course corrections along the way. To date, there is no state regulatory program that has become a standard template for other states to use. States that are developing their own rules and policies have tended to pick and choose from the example of multiple states. Some state markets have implemented market share caps to limit the influence of any single entity on the overall market. In New York’s case, this may be a solution that strikes the right balance between market access for smaller operators and allowing participation by larger firms.

Business Licenses: To Restrict or Not?

Limited License Strategy: In all states, any cannabis that is produced or manufactured in a state must be sold and remain in that state. There is an ongoing debate among states about whether to restrict licenses (by placing caps on them), or to allow unlimited licenses. A limited license strategy offers several benefits, but if these limited licenses are not managed actively, the result has shown to be mixed. Limited license structures have shown that they tend to limit access to the market for smaller, minority or female-owned businesses.

Limited License Structures - Benefits:

-

Value of the license is high

-

Revenues per license remain high

-

Greater chance for profitability

Limited License Structures - Risks:

-

Insufficient cannabis supply in the market

-

Higher, uncompetitive prices than the illicit market

-

Slower consumer conversions from illicit to legal

Unlimited License Strategy: With lower barriers to entry, smaller firms, and minority and female owned businesses can participate in greater numbers than in states with license caps. Unlimited license structures offer greater opportunities for broader participation in the market, but provide a broad set of downsides, including a greater propensity to oversupply the market. In states where there is oversupply, prices decline, which is good for illicit to legal consumer conversions, however price declines also lower margins, reduce profitability and disproportionately impact smaller, women-owned and minority owned businesses. In fact, the experience of many states after a prolonged period of price declines has been an increase in business failures that end up forcing consolidation - a result that favors larger firms.

Unlimited License Structures - Benefits:

-

Access to the market is high

-

Participation by women and minority-owned businesses is high

-

Prices remain low

-

Low prices are good for illicit to legal conversions

Unlimited License Structures - Risks:

-

Value of license is low

-

Revenues per license is low

-

Greater likelihood of oversupply

-

Lower prices reduce profitability

-

Greater likelihood of business failures

Regulatory Policy Makers Must Consider the Elasticity of Cannabis Demand

As difficult as it may be, policy makers must be cognizant of the impact the regulatory policies at both the state and federal levels will have on consumer behavior. Cannabis consumers are very sophisticated in how they react to changes in policy, particularly when it comes to how policy impacts price. Consumers generally want to participate in the legal market and even pay a premium above illicit market prices, just as long as that premium is not to great. If the overall legal price is within 10% - 15% of the illicit prices, consumer participation in the legal market will convert quickly. However, when legal prices exceed that range, illicit to legal consumer conversions slow markedly. The pace of conversions based on pricing sensitivity is very predictable in this regard.

A Summary of Cannabis Demand Elasticity

-

Cannabis consumers are price sensitive

-

Cannabis consumers will travel for price, even to other states or jurisdictions

-

Higher prices slow down the rate of conversion from illicit to legal channels

-

For every 1% increase in the price of legal cannabis relative to the illicit market there is a 2.4% - 2.8% reduction in the rate of illicit to legal conversions

-

Simply put: for every 10,000 consumers, 240 will remain in the illicit market, for every 1% of price difference

-

There are roughly 5.2 million cannabis consumers in New York (Defined as consumed cannabis in the past year)

Larger Firms Can Support A New York Ramp

Cannabis consumers in New York consume over 2.8 million pounds of cultivated output per year. This amount does not include canna-tourism. As of Q3’22, the State of New York has capacity in place to support roughly 100,000 – 150,000 pounds of cultivated output. This limited cultivated output is pushing legal prices significantly higher than the illicit competition. The current regulatory structure in New York will shape the cannabis market by limiting the supply that is required to keep prices in line with the illicit market. Current legal supplies are falling well short, and will simply not be enough to satisfy any potential demand that does attempt to convert. In an effort to address these obstacles for consumer conversions, larger firms that already have the capacity in place to ramp cultivation output quickly can serve to bridge any gaps in supply, while incentivizing consumers to participate in a robust legal market.

Source: Whitney Economics U.S. Cannabis Supply Report (2022)

The New York License Structure Favors Smaller Firm Access, Limits Supply & Raises Prices

By deploying policies that favor smaller firms, the State of New York is inadvertently limiting the amount of supply capacity in the New York market. Additionally, the supply that does enter the market will be higher priced, due to the fact that smaller firms will be limited in their ability to achieve economies of scale. With higher prices, the conversion of the consumer from the illicit channels will be slower than what has typically been seen in the average market.

The New York Consumer Conversions are Already Performing Below Expectations

New market deployments in cannabis are predictable and follow similar patterns. The pace of the ramps depends on the regulatory structure which controls supply, access and price. New York is already falling behind on the potential of the market from a revenue and output perspective. Supply is forecasted to remain constrained in the New York legal market, thereby maintaining higher than normal legal prices and slowing the pace of illicit to legal consumer conversions. This gap relative to typical ramps is forecasted to increase throughout the decade, and will impact tax and fee revenues, job creation, jeopardizing smaller firms. With a combination of large and small firms supplying the market in the short run, New York has the potential to close this gap. This will in turn, increase the chances for success for the smaller firms once they are able to enter the market and compete.

Source: Whitney Economics

The New York Regulatory Structure Erects High Barriers to Entry for Larger Firms

The New York Regulatory structure is geared towards smaller firms and attempts to limit the amount of vertical integration that can occur, by increasing fees for vertically integrated firms. In some instances, larger firms must pay $5 million for a cultivation license that is part of a vertically integrated structure. By comparison, smaller firms will pay less than $100k for the same license type. In addition, for larger firms, there is a fee assessed on gross revenue. Gross revenue fees are problematic when combined with federal taxations, and many jurisdictions that have implemented gross revenue taxes ultimately discontinue this policy.

Demand for Legal Cannabis will Outstrip Supply and Limit Legal Consumer Participation in New York

As the New York market ramps, based on the proposed licensing structure, there will be greater demand than the amount of legal supply required. Based on an analysis of the licensed capacity in New York, it does not appear that there is enough capacity to support the demand in the short and medium terms (through 2025).

As one of the major keys to success of the deployment of a legal market is the availability of supply, it is imperative that the policy team at the state examines both supply and demand of cannabis in their strategic and license decision making process.

Current Proposed Solutions to Fill Gaps in Cannabis Supply

-

New York Hemp Cultivators: One solution to fill this gap in the short run was to recruit hemp cultivators to grow adult-use cannabis. While there was supply available, the quality of the output produced by the hemp farmers was not acceptable to cannabis consumers and the experiment was not successful. Despite efforts to supply adult-use cannabis by leveraging newly licensed hemp growers, lower quality and lack of retail distribution is reducing demand from legal channels and pushing demand into adjacent states. That represents a failure.

-

Leverage Existing Large Producers: An alternative solution would be to incentivize large adult-use producers to leverage their existing cultivation capacity, and retail operations in order to expand the supply and access and drive demand into the legal market. The introduction of the additional supply would drive down prices in the legal market making legal cannabis competitive relative to the illicit market. This would bridge the gap until smaller operators could come on line. With the successful support of the legal demand by larger firms, smaller firms will remain viable and the social equity program will be sustained.

-

Modified Limited License Strategy: To avoid giving larger operators too much influence over the total market, caps could be placed on future canopy and the number of future retail outlets. The time to limit the access by larger firms is not now, though, for if the New York market gets too far behind the curve in terms of legal capture, it may never catch up. The data is available to predict the level of supply is required to meet the demand, which in turn can help determine the numbers of licenses required to support the demand, maintain reasonable prices and give access to consumers.

Source: Whitney Economics U.S. Cannabis Supply Report (2022)

Social Equity Goals at Risk

The significance of the gap between supply and demand cannot be overstated. The larger the gap, the higher the prices. Higher prices slow the pace of legal conversions. With higher prices and lower demand, small firms will struggle with profitability and debt service, putting social equity goals at risk. A typical retailer requires between $2.0 - $2.5 million per year in revenue to remain viable due to the heavy federal taxation. Low demand could prove to be a significant hurdle for smaller operators.

Large Firms are Not the Biggest Threat to Small Operators in the New York Market

There are several headwinds that are limiting small businesses' ability to ramp in New York. Inflation, access to capital and finance costs are the three stiffest headwinds that face small operators in their attempts to open up the New York Market. This is not an issue that is unique to New York, but it is more prevalent in markets that are just now deploying a regulated market. Larger firms have experience serving the market by growing higher quality cannabis, and smaller firms will need time to ramp and optimize their operations in order to be able to compete.

The Biggest Threats to New Operators are Just Normal Start-up Costs

Right now, the New York cannabis licensees are facing significant challenges just getting started. Start up capital is in short supply and access to capital favors larger firms over smaller ones. Construction inflation is a major factor as prices for construction material such as HVAC, lumber labor and other building material has seen 25 – 40 % inflation over the past year. Unlike product inflation, this is not expected to ease in the near term. With the broader economy facing persistent inflationary pressures, the federal reserve is increasing interest rates. It is commonplace to invest between $1 million to $2 million on a build out, so a 4% rise in interest rates adds an additional $80,000 in interest payments each year. Higher borrowing costs may be too high to be economically viable, price smaller operators out of the market and slow the growth of legal revenues in New York. On the other hand, larger firms tend to have concrete advantages in operating, such as more access to capital and existing underutilized capacity. Larger firms are able to absorb some of the higher costs making them a viable solution to support the near term demand given smaller operators time for the macro environment to settle and inflation and higher interest rates to abate.

With fewer smaller, equity-based firms entering the market, New York will not meet its goal of providing opportunities for social equity licensees, nor will it meet its goals of reducing illicit sales.

Federal Policies Are Impacting State Potential

There are several federal policies that are impacting the viability of smaller operators, no matter where they are. These policies make it more difficult for them to get up and running as well as continuing ongoing operations. Much of New York's policies such as protecting the smaller operator, limiting the influence of large operators and leveling the playing field for small operators' lack of access to capital are state attempts to address issues that are really driven at the federal level. The states can do little to affect the influence of these federal issues.

3 Major Federal Cannabis Policies Impacting the Market: 280E, SAFE Banking & Interstate Commerce

While changes to any one of the below policies individually would have a significant and positive effect on the health of the cannabis industry, resistance to change and political gridlock is hurting the chances of any change from occurring. Look for the status quo both in the short and medium term through 2024. Meanwhile, states simply cannot solve the issues that have been created by the federal government.

280E

Background: Internal Revenue Code 280E has been a major thorn in the side of cannabis operators ever since cannabis reform began to take shape in 1996. The policy that prohibits operators from deducting common business deductions is putting a stranglehold on cannabis operators’ ability to generate profits. In some cases, the effective tax rate for cannabis dispensaries is in excess of 70%. IRC 280E is a 40 year-old policy that was intended to dissuade people from participating in federally illegal activities. The tax code has remained in effect unchanged despite cannabis reform evolving at a rapid pace, particularly since 2014. In all, cannabis operators pay over $2.0 billion per year in excess taxes more than they would if treated like a normal business. Heavy taxation at both the state and federal level, when combined, is literally taxing companies out of business and is cited as a top concern by the industry. This tax program disproportionately impacts smaller businesses. 280E tax policy is considered just as much a social justice issue as it is an economic justice issue.

Issues Preventing Reform: In 2017, there was a scoring of cannabis tax reform that indicated that any tax reform would result in a negative impact of revenues received by the U.S. treasury. This score was static and did not look at the other economic benefits to tax reform such as demand elasticity driven increased revenues, increased employment, payroll and business taxes. The negative legislative scoring is commonly cited as the top reason why discussions about cannabis tax reform are not on the table. Whitney Economics has been asked to re-score legislation by many stakeholders in the cannabis industry.

Expected Outcome: Despite the fact that cannabis tax reform would increase profitability, tax revenues, employment and address economic and social justice issues, the likelihood of passage in the near is remote. This ongoing issue represents significant challenges for smaller operators in New York and across the country. This continues to have a suppressive effect on the growth of the industry in the near term and drive business consolidation instead of expansion. Expect further economic stress on cannabis operators for the foreseeable future.

SAFE Banking

Background: Cannabis operators have limited access to traditional banking and financial services. This is creating economic stress and significant operations costs. Lack of access also creates barriers to entry for smaller operators as well as potential minority-based licensees. Lack of access to banking services also prevents operators from having credit card processing, limits transparency and traceability and significantly increases operational risks. Many view the lack of access to banking as a public safety issue. Safe banking legislation has the support from the American Banking Association and many legislators on both sides of the aisle. Based on a survey deployed by Whitney Economics, 71% of respondents indicated that access to banking and financial services was their top issue as an operator in the cannabis industry.

Issues Preventing Reform: There is an argument that providing banking and access to capital markets would disproportionately favor larger operators and white-owned businesses, and reduce the likelihood of cannabis reform in other areas such as social equity. This argument does not seem to correlate with the data. There are over 42,500 state-based cannabis licenses in the United States, most of which are small, single entities, and not large multi- state operators.

Expected Outcome: Despite support in both chambers, banking reform was not included in legislation at the end of the last congress. Look for some potential incremental reform by 2024 if it can be passed again in the House of Representatives.

Interstate Commerce

Background: The concept of interstate commerce gained significant traction upon the collapse of wholesale prices in Oregon in 2017 and 2018 due to oversupply. In general, given the siloed markets in each cannabis regulated state, there is only so much demand to go around. If a state becomes oversupplied with cannabis products, prices decrease. This impacts operators' margins and profitability and forces operators to weigh if participation in illicit markets to save their business is a viable option, versus closing an operation that simply doesn’t have bankruptcy protections. One solution to the oversaturation effect is broadening the available market to generate more demand.

An obvious expansion of demand could come through interstate commerce. The concept is that producing/ exporting states in the west sell cannabis raw material to states in the east. Interstate commerce would potentially solve excess supply dilemmas at the state level, and support emerging state market ramps. Some argue that this also will prevent significant wealth destruction once full federal legalization occurs and higher cost suppliers are forced out of the market. One other benefit of interstate commerce is that it offers legacy suppliers the ability to participate in the legal system. This would increase legal sales and would drive more legal tax revenue that would otherwise go uncollected in the illicit market.

Issues Preventing Reform: One of the biggest issues preventing reform is the current federal illegality of cannabis. While there are legal debates about how interstate commerce is already legal or that states can get around the federal illegality by signing compacts with one another, few if any operators are willing to take the risk. Interstate commerce would eventually harmonize prices nationally, which would ironically reduce the influence of the illicit market by incentivizing legal participation. New York could benefit from interstate commerce if it partnered with other producer states like Oregon or California where laws supporting interstate commerce are already on the books.

Expected Outcome: Although interstate commerce would help protect cultivators from fluctuations in wholesale prices, increase tax revenues both at the state and federal levels, and provide a disincentive to illicit participation, this is the least likely of all policies to be changed in the near term. Therefore, expect pricing volatility to persist in markets with large numbers of cultivation licenses and more canopy than legal demand and expect prices to remain elevated in states with limited supply.

Vertical Integration is Beneficial from a Federal Tax Perspective

A vertically integrated business structure is beneficial to a firm as it enables a firm to spread out costs and control all aspects of the cost of production. The current federal cannabis tax codes favor vertical integration as a firm is able to deduct more expenses on the firm’s federal taxes. Cannabis firms are already taxed heavily at the federal tax level, so a vertically integrated structure may make the difference between success or failure of a firm.

New York’s Regulatory and Tax Policies Runs Contrary to Federal Tax Policy

By erecting barriers against vertical integration, New York is offering more opportunities for smaller firms, but puts smaller firms at a disadvantage both relative to the illicit market competition, by having higher costs of production, and at a disadvantage from a tax and profitability perspective. It is commonplace for states and local jurisdictions to ignore federal taxation in their licensing and tax related policies.

Conclusion and Recommendations

Cannabis policy is very complex. Policy that favors on objective in one area may have unintended consequences in others. There is no one dominant model that states can leverage. Despite this as long as policy markers consider the three keys to a successful deployment: Adequate supply, consumer access and reasonable pricing, a regulatory roll-out can achieve some success in terms of giving opportunities to social equity applicants, reduce the impact of the illicit market and to create jobs and expand state revenues.

The current policies being deployed while favoring social equity participants may not meet other key public policy objectives. Based upon the rationale provided above, we are convinced that New York state should adopt a modified limited license strategy for larger operators. With respect to the overarching goals of protecting and nurturing smaller operators, the safest and least volatile market conditions would be created with the inclusion of larger operators.

We recommend:

-

Incentivize big operators to provide supply in the short run, rather than erect significant barriers to entry.

This gives smaller firms the time to: -

secure funding

-

complete their required build outs

-

ramp up to a point of stable operation.

-

Avoid enabling larger operators to gain too much influence over the total market that could potentially threaten opportunities for smaller, equity based operators. Caps and limits can be placed on:

-

Total percentage of over canopy required in 2025

-

Total retail space as a percentage of population

-

Percentage of total licenses

-

-

Establish programs whereby larger firms can provide mentorship and training for smaller operators so that equity applicants can grow and flourish

-

In the short run, it is imperative to provide consumers with access, supply and reasonable prices.

Competition drives innovation, creativity and differentiation in all of these markets. This fact makes for a healthy marketplace. Smaller firms need larger firms, and larger firms need smaller ones. Every day, smaller grocery operators co-exist with larger ones and vice versa. Why should the cannabis industry be any different?

Beau R. Whitney

Chief Economist

Whitney Economics

Beau@Whitneyeconomics.com

503-724-3084

About Whitney Economics

Beau Whitney is the founder and Chief Economist at Whitney Economics, a global leader in cannabis and hemp business consulting, data, and economic research. Whitney Economics is based in Portland, Oregon. Beau has provided policy recommendations at the state, national and international levels and is considered an authority on cannabis economics and the supply chain.