Is Now the Time to Invest In Industrial Hemp? – Observations on the EU and U.S. Opportunities

A Convergence of Thought Leaders Yields Optimism

On June 7-9, a group of industrial hemp thought leaders converged on Brussels, Belgium, for the annual European Industrial Hemp Association (EIHA) conference. This is a significant event that brings together business operators and other stakeholders from around the world in order to discuss challenges and opportunities in the Industrial Hemp industry. One striking observation about this year’s conference is that, despite encountering continuing challenges along the way, attendees agreed that the potential and future of hemp is bright.

Bringing in the Economist

As an economist, I generally look at markets differently than most people, and this is because I focus on market potential and emerging opportunities in the space. Typically, my analysis tends to concentrate on 1) economic impacts, 2) business opportunities, and 3) approaches through which governments and operators can expand markets and so generate economic growth. To prepare for the EIHA conference, the Whitney Economics team conducted extensive research on the hemp industry in each of the 27 European Union countries, and then compared those markets to the U.S. hemp market. The differences between hemp in the EU and the US are striking.

Industrial Hemp: The EU has History, the U.S. has Enthusiasm

Compared with the United States, the European markets have a long history with industrial hemp. While the EU has an larger, overarching set of guidelines for member countries to follow, it generally leaves the details up to the individual countries to manage and implement. Each EU member state has taken its own approach to hemp, and has subsequently carved out a niche. For example, France is more focused on the value-added side of the hemp industry by being a hub for processing, while countries on the Eastern frontier of Europe tend to focus on cultivation, and less so upon value added services.

Different Approaches Create Opportunities

Because EU member states have different approaches, there are opportunities for targeted investment that will help expand new business ventures, fill the voids and address the differences in approach. For example, bringing processing and other critical value-added services closer to European farmers is a tremendous opportunity that requires investment, and is likely to generate good returns. The processing of industrial hemp is critical for farmers to take their products to market and to supply into other processors and manufacturing. However, shipping raw materials great distances in order to dry, store, produce or transform the raw materials into consumer products can add costs and reduce marketability.

-

Localized processing is just one of many emerging opportunities for hemp across a number of industries in Europe.

-

The broad range of applications and the environmental qualities of hemp mean that the market is poised for rapid expansion in both the near and medium term.

-

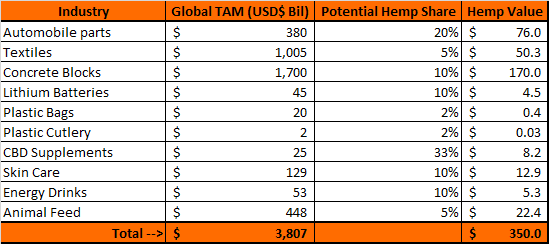

The table below provides an indication of its potential in a number of industries.

Source: Whitney Economics

U.S. Market is Not as Advanced as Europe

By contrast, the U.S. industrial hemp market is still nascent. There was a ban on industrial hemp that lasted decades, which put the U.S. at a competitive disadvantage when compared to Europe. The recent legalization of hemp in 2018, created a surge in supply as many farmers and operators saw the opportunities in hemp, and especially in the area of cannabinoids.

Unfortunately, the infrastructure was not in place to support the influx of supply from farmers, and the opportunities many farmers anticipated did not materialize. Even the U.S. federal regulators have struggled with regulating hemp. Given it was so new to the U.S., it was not well understood. As a result, the regulatory roll-outs have often generated more harm than good for operators, investors and regulators alike.

Simply Put: The U.S. is Cannabinoid Focused; EU is Focused on Fiber and Grain

Most of the enthusiasm in the U.S. has been centered around cultivation and processing for cannabinoids. This stands in contrast with the EU, which has a long history of working with hemp for grain and fiber.

Cannabinoid Boom and Bust Cycle in the U.S.

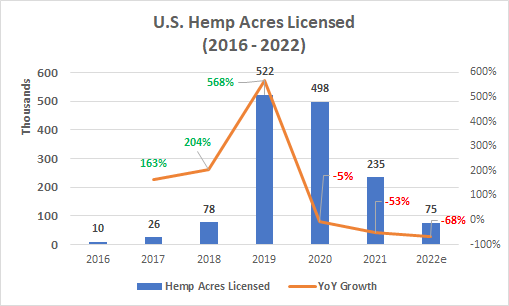

As a result of the intense focus on cannabinoids, the U.S. experienced a boom-and-bust cycle that is rather historic in nature. Prior to 2018, the U.S. hemp market looked poised to follow a path similar to the EU, but turned quickly towards cannabinoid production. The market then experienced serious oversupply and a resulting crash in pricing. To illustrate this point, in 2018, the price of refined CBD was approximately $40,000 per kg, while in Q2 '23 the price of refined CBD was hovering at below $300 per kg. As a result, many American farmers are leaving the market as production costs are higher than the CBD price on the wholesale market.

Source: Whitney Economics

Source: Whitney Economics

Despite the Boom and Bust Cycle, Opportunities Remain in the U.S.

Although the U.S. saw massive volatility as a result in the surge of interest in cannabinoids, the industry has reset itself. Opportunities are emerging in fiber and grains similar to those in Europe. Growth in hemp construction materials, automotive parts, and grains for animal and human consumption is increasing. The key question is whether or not the supply of hemp has pulled back too far to support the market’s growth. This will become quite evident over the next 6 – 18 months.

A Tale of Two Markets

One key message to investors is that there are opportunities in both regions, but there are different risks associated with each. Production in the EU is relatively small at the moment, so opportunities are related to how quickly markets across the continent can scale up. The U.S. is still a very nascent industry and it is fraught with regulatory murkiness, but once it matures, represents greater and arguably more significant upside potential.

More Education will Result is Greater Opportunity

Conferences such as the EIHA conference in Brussels are a reminder that education is key for the industry. Education for policy makers, consumers, operators and investors is still required.

Despite the obstacles that are facing the industry in general, the future remains very bright for the industrial hemp sector in both the EU and in the U.S.

Beau Whitney

Whitney Economics

503-724-3084

About Whitney Economics

Beau Whitney is the founder and Chief Economist at Whitney Economics, a global leader in cannabis and hemp business consulting, data, and economic research. Whitney Economics is based in Portland, Oregon. Beau has provided policy recommendations at the state, national and international levels and is considered an authority on cannabis economics and the supply chain.