A Growing Divergence. How will Declining Acreage Impact Hemp’s Potential

Hemp has been a hot topic as of late, even when it comes to adult-use and medical policies. Despite being separated legally, there seems to be an intersection when it comes to how cannabis and hemp can coexist. Despite these discussions, there is a lot of education that needs to be done on hemp in general and the opportunities that expanding the hemp market brings.

Three Industries within the Industry

The three pillars of the hemp industry: Fiber, grain and cannabinoids have had a rough go of things as of late. Not only are policy makers so focused on hemp derived cannabinoid that they are inadvertently and negatively impacting the fiber and grain sectors, but with falling prices, lacked of investors and regulatory murkiness, participation in the hemp industry is at a pre-farm bill low point.

The Surge of Participation Has Declined to the Point of Over Correction

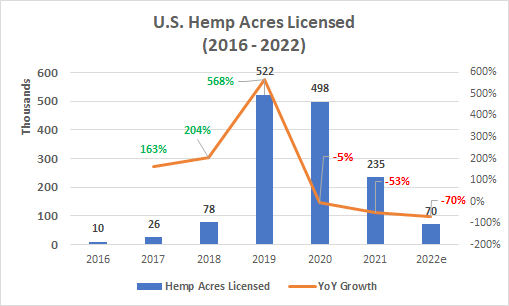

As many in the hemp industry know, the number of acres licensed grew significantly after the passage of the 2018 farm bill. With over 80% of licensed acres dedicated to cannabinoid based cultivation even in 2020 and 2021, the collapse of the hemp cultivation market has seen its steepest declines in that sector, while fiber and grain cultivation has remained steadfast. As a result the U.S. hemp cultivation industry has the fewest licensed acres in the post farm-bill era.

Source: Vote Hemp (2016 – 2018), Whitney Economics (2019 – 2022), Randall Lusson (2021)

States Policy Focused on Hemp-Derived Cannabinoids

State based regulations are limiting the sale and distribution of hemp-derived cannabinoids despite the fact that this is impacting interstate commerce and eliminating both jobs and businesses in this $20 billion industry. This has impacted hemp cannabinoid farmers and operators across the country and has created uncertainties throughout the entire hemp industry. Understandably, operators are exiting the industry and putting supply chains at risk.

Show me the Money? What Money

With over supply of hemp biomass for cannabinoids, farmers can no longer make a profit. As a result, farmers are pulling out of the market at a significant pace. The question becomes are there enough farmers to supply the growth of cannabinoid demand throughout the country. An early indicator of potential supply constraints is coming in the form of stable to increased prices in the biomass and CBD markets.

Fiber and Grains Growth being Suppressed

Despite the uncertainty, fiber farmers are seeing the potential opportunity in the U.S., which to this point has been supported by fiber imports from the EU. With the U.S. market beginning to open up for automobile parts, hempcrete and plant based plastic alternatives, there is a disconnect between the opportunity for fiber and market participation. Interestingly, while the percentage of acres in the hemp market associated with fiber production is increasing, that percentage is based on fewer and fewer cannabinoid farming acres. In fact, even if fiber represented 35% of the entire amount of licensed acres in the U.S. This would barely be at the pre-farm-bill levels.

Fiber Demand Outpacing Acres of Supply

With hempcrete and hemp wood certified at the federal level as viable construction materials, plant-based plastics making inroads as a plastic alternative and automobile manufacturers increasing the percentage of auto parts containing hemp, demand for hemp fibers is poised to increase significantly in 2023 and 2024. Unfortunately, the pace of growth in the demand for fiber appears to be outpacing the number of acres licensed in the U.S. This could portend a constraint in the supply, leading to increased costs and extended lead-times. At the very time that hemp fiber is hoping for economies of scale to reduce costs and compete with traditional products on price, there is a real possibility that raw material supply will be constrained and higher costs will occur, resulting in a slower ramp and adoption of hemp-based products.

Convergence Impacted by Divergence

So, at a time where there should be a convergence of factors that would benefit hemp, increased supply, lower costs and greater adoption of the industry, there seems to be a divergence associated with the supply chain (A.K.A. higher growth and less industry participation). On the surface, this appears that this disconnect will impact the ramps in multiple markets and push out the demand.

Our Outlook

Based on a supply chain assessment, it appears that 2023 is already predestined to supply shortages, or at best, a continued decline in available inventories. Licensed acreage is low and there is little interest in adding more. Add to this the fact that the cost of capital is higher and the supply chain is still fragmented.

The industry will be better positioned for success in 2024, assuming there is a better coordinating and communication about where the demand is coming from. Manufacturers will need to recruit new growers and develop more connections between the farmers and the processors / manufacturers. By coordinating activities, manufacturers will have continuity of supply that will support confidence in the market and confidence in future growth. Coordination will also provide farmers with price stability and assurances that there will be a home for their crop.

What can be done to address this?

This coordinated effort must come from the industry as the U.S. federal government is still stuck in the malaise of cannabinoid policy. The one federal bright spot is the USDA, where they are trying to develop policies to bridge the gap between farmers and manufacturers. For this season, though, it is too late. However, given the potential of hemp in multiple sectors, it is imperative that the industry gains its voice, partner with the USDA to fund create opportunities that will propel the growth of the hemp industry moving forward. Without public/private partnership to differentiate the fiber and grain growth opportunities, the industry will continue to be impacted by unintentionally impacted by overreaching cannabinoid policies.

About Whitney Economics

Beau Whitney is the founder and Chief Economist at Whitney Economics, a global leader in cannabis and hemp business consulting, data, and economic research. Whitney Economics is based in Portland, Oregon. Beau has provided policy recommendations at the state, national and international levels and is considered an authority on cannabis economics and the supply chain.